AWIP, Indian Polity & The Constitution of India

Q. Describe the constitutional provisions regarding the Finance Commission of India and explain its functions.

The Finance Commission of India is a constitutional body established under Article 280 of the Indian Constitution. It plays a crucial role in defining the financial relations between the central government and the state governments. Here is a detailed overview of the constitutional provisions and functions of the Finance Commission:

Constitutional Provisions:

Article 280: Finance Commission

- Establishment:

- Article 280(1) mandates the President to constitute a Finance Commission within two years from the commencement of the Constitution and thereafter at the expiration of every fifth year or at such earlier time as the President considers necessary.

- Composition:

- The Finance Commission consists of a chairman and four other members appointed by the President. Parliament may by law determine the qualifications requisite for appointment as members of the Commission and the manner in which they should be selected.

- Duties:

- The Finance Commission is required to make recommendations to the President regarding:

- The distribution of net proceeds of taxes between the Union and the States, and the allocation between the States of the respective shares of such proceeds.

- The principles that should govern the grants-in-aid of the revenues of the States out of the Consolidated Fund of India.

- Any other matter referred to the Commission by the President in the interests of sound finance.

- The Finance Commission is required to make recommendations to the President regarding:

- Powers:

- The Commission has the power to determine its own procedure and has all the powers of a civil court under the Code of Civil Procedure, 1908, in respect of summoning and enforcing the attendance of witnesses, requiring the production of any document, and requisitioning any public record.

Functions of the Finance Commission:

- Tax Distribution:

- Revenue Sharing: One of the primary functions of the Finance Commission is to recommend how the net proceeds of taxes are to be distributed between the Centre and the States. This includes both vertical distribution (between the Centre and States) and horizontal distribution (among the States themselves).

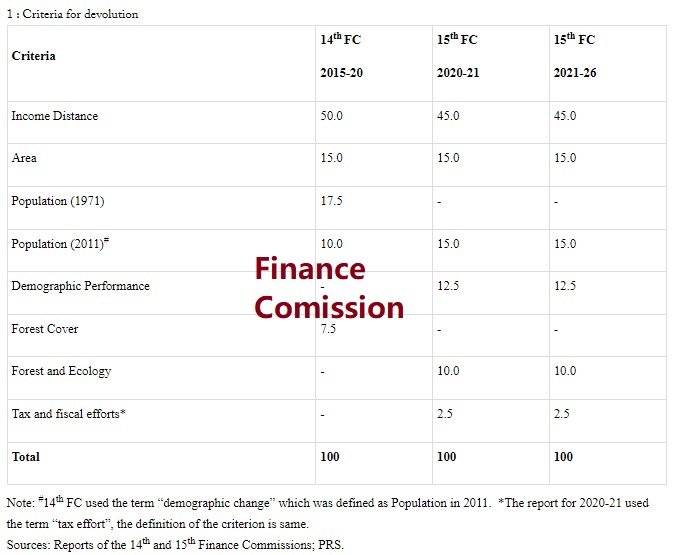

- Criteria for Distribution: The Commission considers factors like population, area, income levels, and fiscal discipline of states while recommending the distribution formula.

- Grants-in-Aid:

- Principles of Aid: The Finance Commission recommends the principles governing the grants-in-aid to the states from the Consolidated Fund of India. These grants are provided to states to help them manage their finances and to ensure a certain level of public services across the country.

- Specific Purposes: The Commission can also recommend specific purpose grants, such as for disaster relief or development of certain backward areas.

- Review of Financial Position:

- Assessment: The Finance Commission assesses the financial position of the Union and the States. This includes evaluating the financial performance, revenue and expenditure patterns, and fiscal policies of both levels of government.

- Incentives for Performance: The Commission may recommend incentives for states to improve their fiscal performance and adopt sound fiscal management practices.

- Other Matters Referred by the President:

- Special Assignments: The President can refer any other matter to the Finance Commission in the interest of sound finance. This allows the Commission to address contemporary financial issues and challenges faced by the country.

Key Considerations:

- Equity and Efficiency: The recommendations of the Finance Commission aim to balance equity and efficiency, ensuring fair distribution of resources while promoting fiscal discipline.

- Flexibility: The Commission’s recommendations provide flexibility to address the varying needs and capacities of different states, promoting balanced regional development.

- Consultative Process: The Commission engages with various stakeholders, including state governments, central ministries, and other experts, to gather inputs and data for informed decision-making.

Impact:

- The recommendations of the Finance Commission are crucial for maintaining fiscal federalism in India. They influence the fiscal policies and budgetary allocations at both central and state levels.

- While the recommendations are advisory in nature, they carry significant weight and are generally accepted and implemented by the government.

Conclusion:

The Finance Commission of India plays a pivotal role in ensuring a balanced and equitable financial relationship between the Centre and the States. By recommending the distribution of tax revenues and grants-in-aid, it helps in addressing regional disparities and promoting fiscal discipline across the country. The constitutional provisions ensure that the Finance Commission functions independently and effectively in fulfilling its mandate.

Note:

The 15th Finance Commission was constituted on November 27, 2017. It made recommendations covering the period of six years commencing on 1st April, 2020 through its Interim and Final Reports. The recommendations of the Fifteenth Finance Commission are valid upto the financial year 2025-26.

The 16th Finance Commission’s recommendations, upon the acceptance by the government, would cover the period of five (5) years commencing April 1, 2026.

Article 280(1) of the Constitutions lays down that the modalities for setting up of a Finance Commission to make recommendation on the distribution of net proceeds of taxes between the Union and the States, allocation between the States of respective shares of such proceeds; grants- in-aid and the revenues of the States and measures needed to supplement the resources of the Panchayats during the award period.

Terms of Reference for the Sixteenth Finance Commission:

The Finance Commission shall make recommendations as to the following matters, namely:

- The distribution between the Union and the States of the net proceeds of taxes which are to be, or may be, divided between them under Chapter I, Part XII of the Constitution and the allocation between the States of the respective shares of such proceeds;

- The principles which should govern the grants-in-aid of the revenues of the States out of the Consolidated Fund of India and the sums to be paid to the States by way of grants-in-aid of their revenues under article 275 of the Constitution for the purposes other than those specified in the provisos to clause (1) of that article; and

- The measures needed to augment the Consolidated Fund of a State to supplement the resources of the Panchayats and Municipalities in the State on the basis of the recommendations made by the Finance Commission of the State.

The Commission may review the present arrangements on financing Disaster Management initiatives, with reference to the funds constituted under the Disaster Management Act, 2005 (53 of 2005), and make appropriate recommendations thereon.

The Commission shall make its report available by 31st day of October, 2025 covering a period of five years commencing on the 1st day of April, 2026.