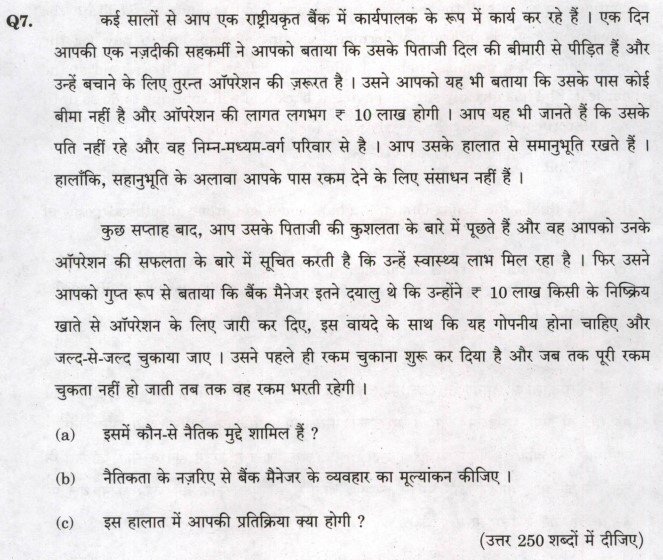

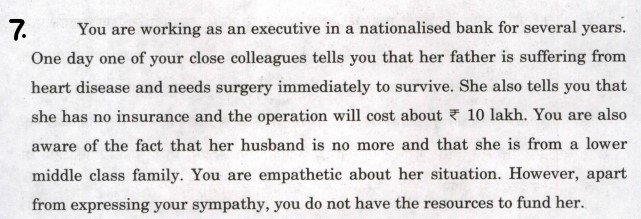

(a) Ethical Issues Involved

- Misuse of Authority: The bank manager used his authority to access funds from a dormant account without the account holder’s consent. This is a breach of fiduciary duty and trust.

- Violation of Bank Policies: Banks have strict policies regarding the handling of dormant accounts and the release of funds. The manager’s actions likely violated these policies and regulations.

- Confidentiality and Transparency: The transaction was conducted secretly, which raises concerns about transparency and the proper recording of bank activities.

- Potential Legal Consequences: The use of funds without authorization can have legal repercussions for both the bank and the individuals involved.

- Fairness and Equity: Using dormant account funds to help one employee may be seen as favoritism, potentially creating an unfair working environment.

(b) Evaluation of the Bank Manager’s Behavior

From an ethical point of view, the bank manager’s behavior can be evaluated as follows:

- Positive Intentions:

- Compassion: The manager acted out of compassion and a desire to help an employee in a dire situation.

- Responsibility: The manager took steps to ensure the money would be repaid, showing a sense of responsibility towards the bank’s assets.

- Negative Actions:

- Breach of Trust: By accessing funds from a dormant account without authorization, the manager breached the trust placed in him by the bank and its customers.

- Policy Violation: The action likely violated bank policies and could lead to disciplinary action or legal consequences.

- Risk of Precedent: Such actions could set a dangerous precedent, encouraging others to circumvent procedures for personal or empathetic reasons.

- Lack of Transparency: Conducting the transaction secretly undermines the principles of transparency and accountability in banking operations.

(c) How Would You React to the Situation?

- Assessing the Situation: I would carefully assess the ethical and legal implications of the situation. Understanding the full context and potential consequences is crucial before taking any action.

- Speaking with the Manager: As I understand that the bank manager’s actions, although well-intentioned, are unethical and illegal. I would discuss the situation with the bank manager privately. Expressing my concerns about the ethical and legal implications of his actions would be important.

- Encouraging Rectification: I would encourage the manager to rectify the situation, such as by reporting the transaction to higher authorities or finding a legitimate way to cover the repayment without using unauthorized funds.

- Support for the Colleague: While maintaining confidentiality, I would explore other ways to support the colleague, such as setting up a fund or organizing a collection among employees to help with her financial burden.

- Reporting, if Necessary: If the manager is unwilling to address the issue properly or if it poses a risk to the bank’s integrity or if legally obligated, I may need to report the incident to higher authorities within the bank to ensure that ethical standards and regulations are upheld.

- Promoting Ethical Behavior: I would advocate for clearer guidelines and training on ethical behavior and decision-making for all employees to prevent similar situations in the future.