AWIP, Economics, GS P6 (Economy, Geography, Environment...)

Q. What do you understand by the “Capital Market”? In what way is it important to an economy?

Capital Market: A Lifeline for the Economy

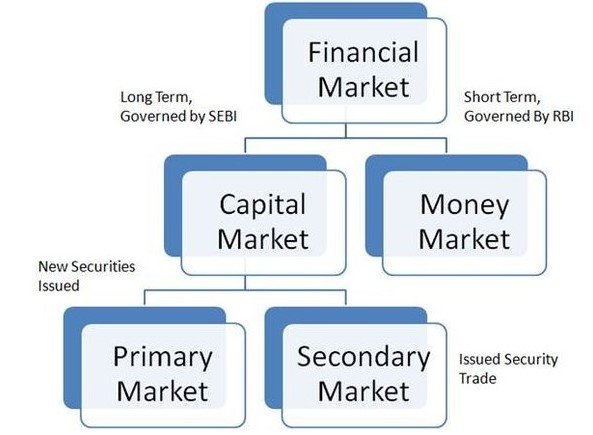

A capital market is essentially a marketplace where long-term securities like stocks and bonds are bought and sold. Unlike money markets, which deal in short-term debt, capital markets focus on financing long-term investments.

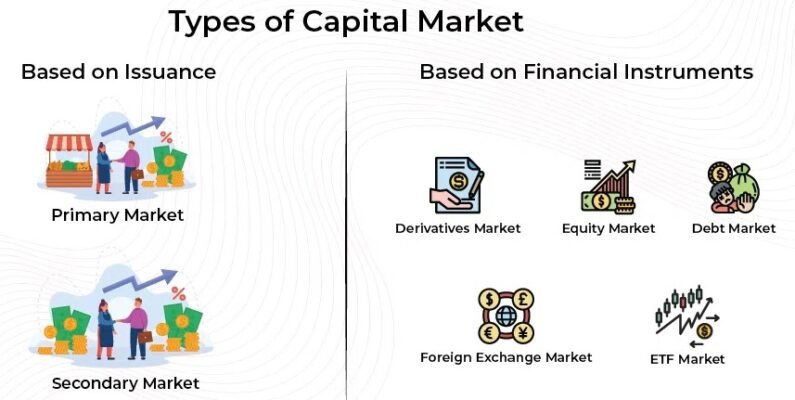

Key components of a capital market:

- Stock market: Where shares of companies are traded.

- Bond market: Where debt securities issued by governments and corporations are traded.

Importance of Capital Market to an Economy

The capital market plays a crucial role in the economic health of a nation. It acts as a bridge between those who have surplus funds (investors) and those who need funds (businesses, governments). Here’s how:

- Mobilization of Savings: It channels savings from households and institutions into productive investments.

- Economic Growth: By providing long-term funds, it supports investment in infrastructure, research and development, and business expansion, which drive economic growth.

- Efficiency: It allocates capital to the most efficient and promising projects, enhancing overall economic productivity.

- Risk Sharing: It allows investors to diversify their portfolios, spreading risk across various securities.

- Corporate Governance: The need to attract investors often compels companies to adopt good corporate governance practices.

- Price Discovery: The continuous buying and selling of securities helps determine fair prices, reflecting the underlying value of assets.

- Job Creation: Investments fueled by capital markets lead to job creation in various sectors.

In essence, a well-functioning capital market is vital for an economy to thrive. It provides the necessary financial resources for businesses to grow, innovate, and create wealth, ultimately contributing to the overall prosperity of a nation.