AWIP, Economics, GS P6 (Economy, Geography, Environment...), News Analysis

Q. India’s household savings rate has been on a downward trajectory, declining from 22.7% of GDP in 2021 to 18.4% in 2023. What are the reasons behind this decline and how can it create a challenge for the government?

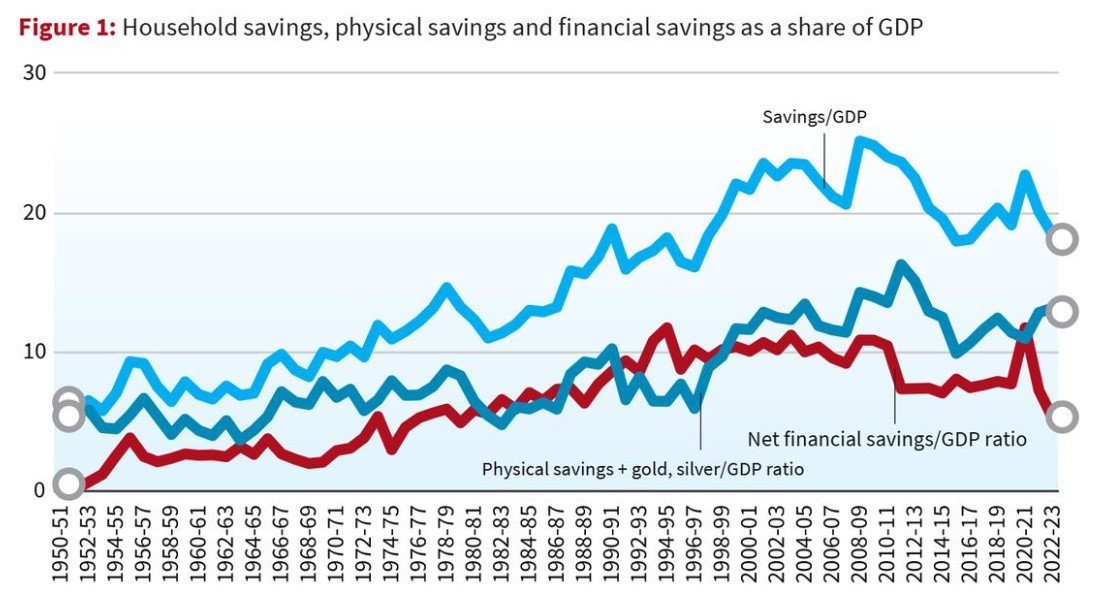

According to the Union Budget 2024, India’s household savings rate has seen a significant decline, falling from 22.7% of GDP in 2021 to 18.4% in 2023. This is due to a sharp decline in net household savings, which fell by Rs. 9 lakh crore to Rs. 14.16 lakh crore in the three years to 2023. In 2022-23, net financial savings reached a five-year low of Rs. 14.2 lakh crore, down from Rs. 17.1 lakh crore in 2021-22. The RBI’s June 2024 Financial Stability Report notes that the decline in household savings, combined with an increase in financial liabilities, could lead to higher household debt. Several factors contribute to this trend, including:

- Rising Consumer Spending: Increased consumer spending, driven by pent-up demand post-pandemic, has led to a reduction in savings as households prioritize consumption over savings.

- Inflationary Pressures: Persistent inflation has eroded the purchasing power of households, leaving less disposable income available for savings after meeting essential expenses.

- Stagnant or Falling Real Incomes: For many households, real income growth has not kept pace with inflation, resulting in a lower ability to save.

- Increased Borrowing: The easy availability of credit has encouraged higher borrowing and spending, often at the expense of savings.

- Investment in Non-Financial Assets: A shift towards investing in real estate and other non-financial assets, often seen as more secure or profitable, has diverted funds away from traditional savings avenues.

The decline in the household savings rate poses significant challenges for the government:

- Reduced Domestic Capital Formation: The government relies heavily on these savings, which are often deposited in banks, held as cash, or invested in equities, to fund essential capital investments in infrastructure and other physical assets. A decrease in household savings can limit the flow of funds available to the government, potentially hindering its ability to finance crucial development projects. Hence, lower household savings can lead to a reduction in domestic capital formation, hampering long-term economic growth and investment.

- Increased Dependence on External Borrowing: With reduced savings, the government may need to rely more on external borrowing to fund its development projects, leading to higher debt levels and potential vulnerability to global economic fluctuations.

- Pressure on Social Welfare Systems: As savings decline, more households may struggle to meet future financial needs, increasing pressure on government welfare programs and social security systems.

Addressing this issue will require a multi-faceted approach, including measures to control inflation, boost income levels, and incentivize savings through policy interventions.