AWIP, Governance, News Analysis, Science & Technology, Technology

India’s Digital Public Infrastructure (DPI): A Fundamental Driver of Social Transformation

Introduction to India’s Digital Public Infrastructure (DPI)

India’s Digital Public Infrastructure (DPI) represents a robust framework designed to enhance digital connectivity, streamline transactions, and foster inclusive growth. At its core, DPI comprises a suite of key components that collectively underpin the nation’s digital ecosystem. These components include Aadhaar, the Unified Payments Interface (UPI), and the India Stack, each playing a pivotal role in driving the country’s digital transformation.

Aadhaar, a unique biometric identification system, serves as the foundation for verifying identities across various services. It has enabled the government to ensure that subsidies, benefits, and services reach the intended beneficiaries, thereby reducing leakages and enhancing transparency. By providing a digital identity to over a billion residents, Aadhaar has facilitated seamless access to a myriad of services, from banking to healthcare.

The Unified Payments Interface (UPI) revolutionizes the financial landscape by enabling instant, real-time payments directly between bank accounts. Launched by the National Payments Corporation of India (NPCI), UPI has fostered a cashless economy by making digital transactions simple, secure, and accessible to all. Its interoperability and integration with various banking and financial services have propelled India’s fintech sector to new heights.

India Stack, a cohesive set of APIs (Application Programming Interfaces), furthers the vision of a digital economy by providing a unified framework for developing scalable and interoperable solutions. It includes components like e-KYC, e-Sign, and DigiLocker, which enable paperless, presence-less, and cashless services. By facilitating the creation of innovative applications, India Stack has democratized access to essential services, empowering citizens and businesses alike.

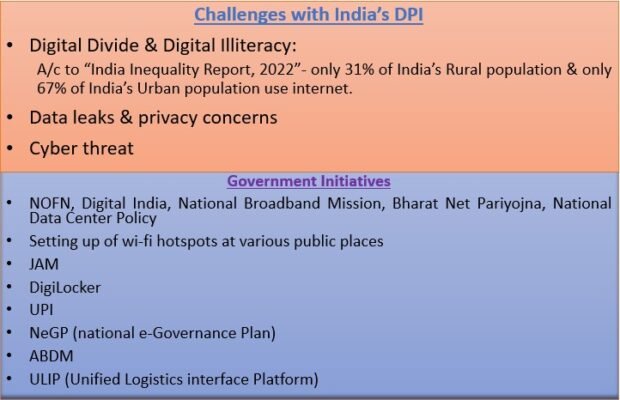

The visionary policies and initiatives spearheaded by the Indian government have been instrumental in the development of DPI. Programs such as Digital India aim to transform the country into a digitally empowered society and knowledge economy. These efforts focus on enhancing digital infrastructure, improving digital literacy, and ensuring the delivery of government services electronically. The overarching objectives of these initiatives are to promote inclusive growth, bridge the digital divide, and position India as a global leader in the digital arena.

Impact on Financial Inclusion

India’s Digital Public Infrastructure (DPI) has significantly transformed financial inclusion, playing a pivotal role in democratizing access to banking services. One of the most notable advancements has been the introduction and widespread adoption of the Unified Payments Interface (UPI). Launched in 2016, UPI has redefined the financial landscape by enabling seamless, real-time money transfers across different banks via mobile devices. This platform has been instrumental in bringing millions of unbanked and underbanked individuals into the digital economy.

An impressive statistic that underscores this transformation is the exponential growth in digital transactions in India. According to data from the National Payments Corporation of India (NPCI), UPI transactions surged from a mere 100 million in October 2017 to over 2.2 billion in October 2020. This meteoric rise highlights the platform’s role in reducing cash dependency and facilitating financial inclusion across the country.

Moreover, DPI has significantly impacted rural and marginalized communities. Financial technology, or fintech, solutions have empowered these communities by providing them with access to essential banking services. For instance, the Pradhan Mantri Jan Dhan Yojana (PMJDY), a financial inclusion program, has leveraged DPI to open over 420 million bank accounts, with a substantial portion belonging to rural and semi-urban populations. This initiative has not only provided a safe place for savings but has also ensured access to other financial services such as credit and insurance.

Case studies further illustrate the transformative impact of DPI on financial inclusion. Take, for example, the case of small-scale farmers in remote areas. With the advent of digital payment platforms, farmers can now receive payments for their produce directly into their bank accounts, eliminating the need for middlemen and reducing the risk of fraud. Similarly, small business owners and street vendors have benefited from UPI-enabled transactions, which have streamlined their payment processes and expanded their customer base.

In essence, India’s Digital Public Infrastructure has been a game-changer in promoting financial inclusion. By reducing barriers to banking services and leveraging technology to reach the underserved, DPI has enabled millions of Indians to actively participate in the digital economy, thereby fostering social and economic transformation.

Enhancing Governance and Public Service Delivery

India’s Digital Public Infrastructure (DPI) has been instrumental in revolutionizing governance and public service delivery. One of the cornerstone initiatives in this domain is the Direct Benefit Transfer (DBT) program. By leveraging the Aadhaar system, DBT ensures that subsidies and welfare benefits reach the intended recipients directly, minimizing leakage and reducing opportunities for corruption. This digital identity system has enabled the government to authenticate beneficiaries with precision and streamline the distribution process, thereby enhancing efficiency and transparency.

Beyond DBT, digital identity and e-governance platforms have played a crucial role in modernizing bureaucratic processes. For instance, the introduction of the e-Sign service allows citizens to sign documents digitally, eliminating the need for physical presence and reducing paperwork. This not only speeds up administrative procedures but also cuts down operational costs. The digital locker system, DigiLocker, provides a secure repository for storing and sharing documents, which further simplifies interactions with various governmental departments.

Moreover, DPI has had a significant impact on reducing corruption and increasing accountability. The implementation of real-time monitoring systems and digital audits has enhanced transparency in governmental operations. As transactions and interactions are logged and traceable, it becomes easier to detect and prevent malpractices, thereby fostering a culture of accountability.

The benefits of DPI extend to various sectors such as healthcare and education. In healthcare, the Ayushman Bharat Digital Mission (ABDM) aims to create a comprehensive digital health ecosystem. It facilitates the creation of digital health records, which can be accessed and shared seamlessly, ensuring continuity of care. In education, initiatives like the National Digital Library and DIKSHA platform provide students and educators with access to a wealth of resources, promoting inclusive and quality education.

Overall, India’s Digital Public Infrastructure is not just a technological advancement but a fundamental driver of social transformation. By enhancing governance and public service delivery, DPI is paving the way for a more transparent, efficient, and accountable system, thereby improving the quality of life for citizens across the country.

Challenges and Future Prospects

India’s Digital Public Infrastructure (DPI) has been instrumental in driving social transformation, yet it faces several challenges that hinder its full potential. One of the most pressing issues is data privacy and security. With increased digitization comes the risk of cyber threats and unauthorized access to personal data. Ensuring robust cybersecurity measures and stringent data protection regulations is crucial. The government has introduced the Personal Data Protection Bill to address these concerns, aiming to regulate the collection, storage, and processing of personal data.

Another significant challenge is the digital divide. Despite substantial progress, there remains a stark disparity in digital access between urban and rural areas. Remote and underdeveloped regions often lack the necessary infrastructure, such as high-speed internet and reliable electricity, to support DPI initiatives. Bridging this gap requires targeted investments and policies to expand digital infrastructure and make technology accessible to all citizens. Initiatives like the BharatNet project aim to connect rural areas with high-speed broadband and improve digital inclusivity.

Infrastructural limitations pose a further obstacle, particularly in remote areas where logistics and maintenance are challenging. Addressing these limitations involves enhancing physical infrastructure and ensuring consistent power supply, which are critical for the sustainability of DPI efforts. Collaborative efforts between public and private sectors, along with local communities, are essential to overcome these barriers.

Ongoing and future initiatives are pivotal in surmounting these challenges. The government’s focus on digital literacy programs is a step in the right direction. By educating citizens about digital tools and online safety, these programs can empower individuals to participate fully in the digital economy. Additionally, the implementation of new regulations and standards for data security can bolster public trust and encourage wider adoption of digital services.

The future impact of DPI on India’s socio-economic landscape is promising. Emerging technologies, such as artificial intelligence and blockchain, hold the potential to further enhance DPI capabilities, driving innovation and efficiency. These advancements could revolutionize sectors like healthcare, education, and finance, leading to improved service delivery and economic growth. By addressing current challenges and leveraging future technologies, India’s DPI can continue to be a fundamental driver of social transformation.

Question for you: