Introduction:

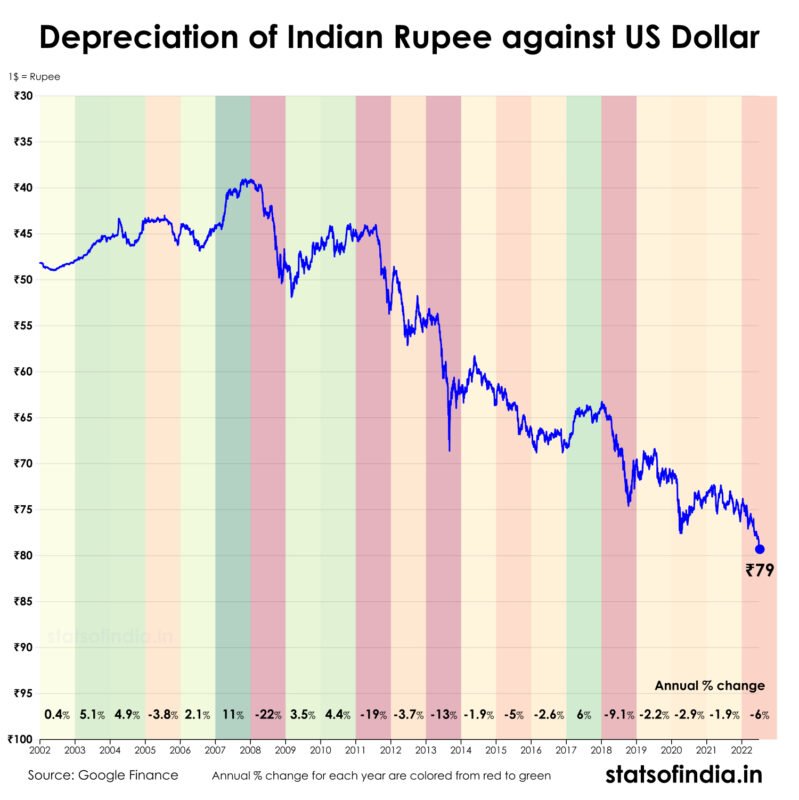

The rupee’s continuous depreciation against the dollar is a pressing concern, driven by global and domestic factors such as rising interest rates in the US, geopolitical tensions, and India’s widening trade deficit, capital outflows, and inflationary pressures. This phenomenon significantly impacts various sectors of the Indian economy, posing challenges for policymakers.

Ripple Effects on Key Sectors

- Imports

Depreciation makes imports costlier, especially for essential commodities like crude oil, fertilizers, and electronics. Higher import bills widen the current account deficit (CAD), exerting inflationary pressures on the economy. For instance, India’s dependence on oil imports magnifies the cascading effects of a weak rupee, influencing fuel prices and transport costs. - Exports

A weaker rupee benefits exporters by making Indian goods and services cheaper in international markets. IT and pharmaceutical sectors, which rely on dollar earnings, gain competitiveness. However, structural issues like supply chain bottlenecks limit broader export growth. - Inflation

Imported inflation becomes a major concern as the cost of essential goods rises. This hits consumers directly and increases production costs for businesses, further driving inflationary trends. - Foreign Investments

Depreciation often triggers capital outflows as foreign investors move toward safer assets. This exacerbates volatility in Indian equity and bond markets, affecting overall investor sentiment. - Tourism and Education Abroad

A falling rupee makes foreign travel and education expensive, impacting Indian students and outbound tourists. Conversely, inbound tourism sees a slight boost due to favorable exchange rates for international visitors. - Debt Servicing

Companies with foreign currency loans face higher repayment burdens, potentially affecting corporate profitability and balance sheets.

Effectiveness of RBI’s Interventions

The Reserve Bank of India (RBI) has implemented various measures to curb volatility in the rupee:

- Forex Market Interventions

RBI sells foreign reserves to provide dollar liquidity, stabilizing the rupee. While effective in the short term, it depletes reserves and is unsustainable for prolonged periods. - Monetary Policy Adjustments

Raising interest rates to attract foreign capital has a dual impact—curbing inflation but also potentially slowing economic growth. - Boosting Forex Inflows

Encouraging non-resident deposits, easing norms for foreign borrowings, and promoting rupee-denominated trade aim to improve dollar supply. - Long-Term Measures

Promoting export-oriented policies and diversifying trade partnerships help address structural imbalances, although such measures take time to yield results.

Challenges and Way Forward

RBI’s interventions provide temporary stability but cannot fully offset external factors like US monetary tightening or global energy price hikes. A long-term approach is needed, focusing on:

- Reducing dependence on imports, especially oil, through renewable energy investments.

- Enhancing export competitiveness via infrastructure improvements and policy support.

- Encouraging foreign direct investment (FDI) and diversifying capital inflows.

Conclusion

Rupee depreciation has far-reaching effects, requiring a balanced approach combining short-term stabilization with structural reforms. While RBI’s measures mitigate immediate volatility, a sustainable solution lies in addressing the trade deficit, fostering economic resilience, and strengthening domestic financial systems.